Yesterday, there was a significant price reduction in Rapport's quotation sheet, which has attracted widespread attention in the industry. We have also received a lot of consulting information. In fact, if we continue to read the market trends we release every week, especially the content related to bare diamond prices, we will find that this phenomenon is not unexpected.

This price reduction is mainly aimed at round diamonds of 0.50-2.99 carats, as well as irregular diamond plates of 1.00-1.99 carats with a cleanliness of SI2.

At the same time, some round and irregular diamonds below 0.29 carats have seen varying degrees of price increases.

From the perspective of downstream markets, retailers' demand for bare diamonds did not show significant growth after the Hong Kong exhibition, but the sentiment of wholesalers is generally optimistic. Although buyers are not in a hurry to make purchases and are constantly calculating price levels, the industry is still generally optimistic about the prospects of the Chinese market.

Signet announced its performance for the fourth and full fiscal quarters, with sales revenue of $2.7 billion, a year-on-year decrease of 5%, and profits of $277 million, a year-on-year decrease of 12%. It is worth noting that both in the fourth quarter and throughout the year, Signet's same store sales are in a declining state. JCK has analyzed this phenomenon and believes that the emotions of American consumers are becoming hesitant, and the demand for engagement diamond rings is also not satisfactory.

Coincidentally, Brilliant Earth also released its own financial report, with fourth quarter sales of $120 million, a year-on-year decrease of 2%, and profits of $6 million, a year-on-year decrease of 46%. This reflects the current situation of weak markets from another perspective.

There is not much information on the midstream side, and the shipment of small diamond particles in Surat is good, which can be confirmed by the price changes of Rapport mentioned at the beginning of the article. Overall, the production capacity of factories is still generally not high, which has brought some trouble to the supply of bare diamonds in specific sections.

Some upstream companies have publicly disclosed their data. Among them, Petra's rough diamond prices increased by 12.5% in the first quarter, and the sales of colored diamonds and small particle white diamonds were both very good. GemDiamonds had sales of $189 million in 2022, a decrease of 6% compared to the strong year of 2021, and a profit of $20 million, a decrease of 20%.

Another noteworthy news is that Burgundy Diamond Mines is preparing to purchase the Ekati mine in Canada for $136 million. We have posted the relevant information on our official website and will not elaborate here.

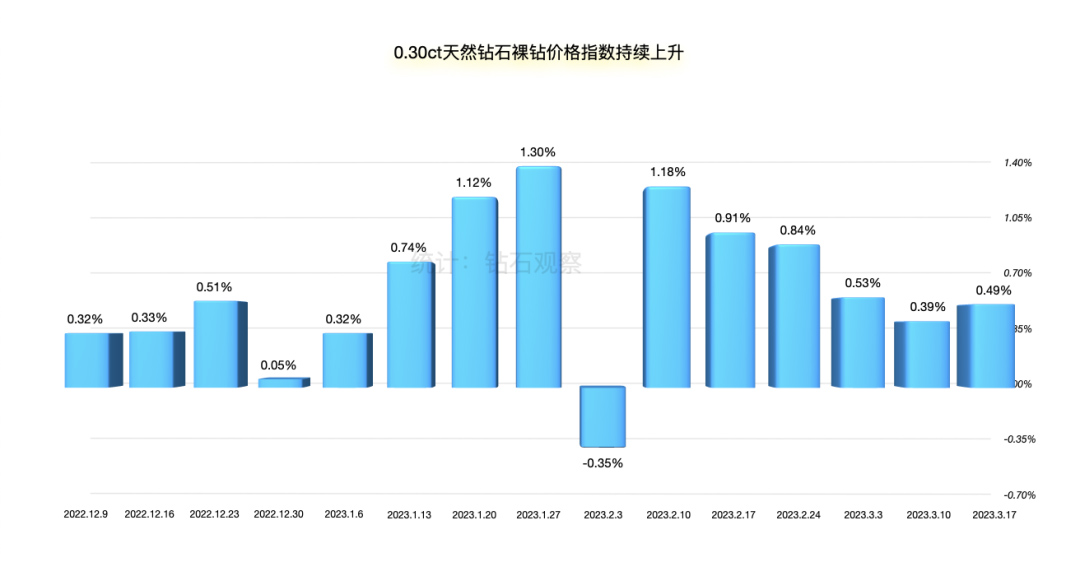

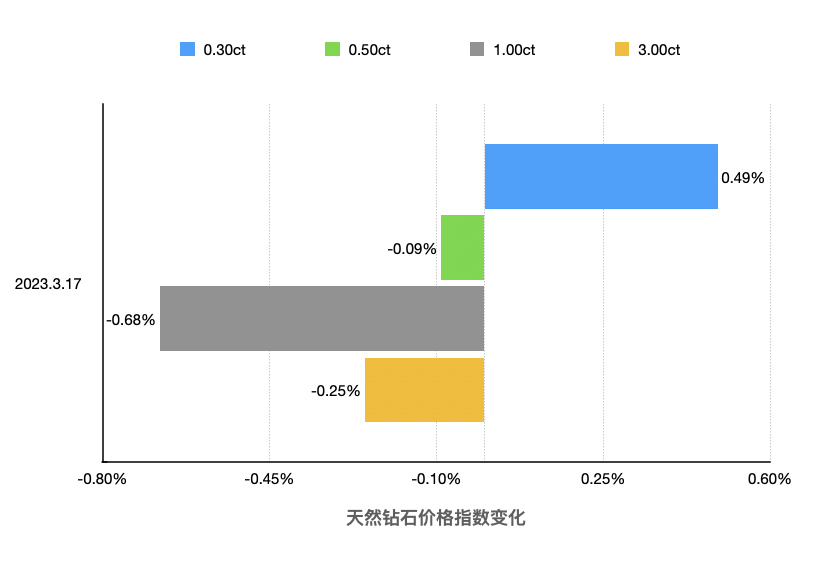

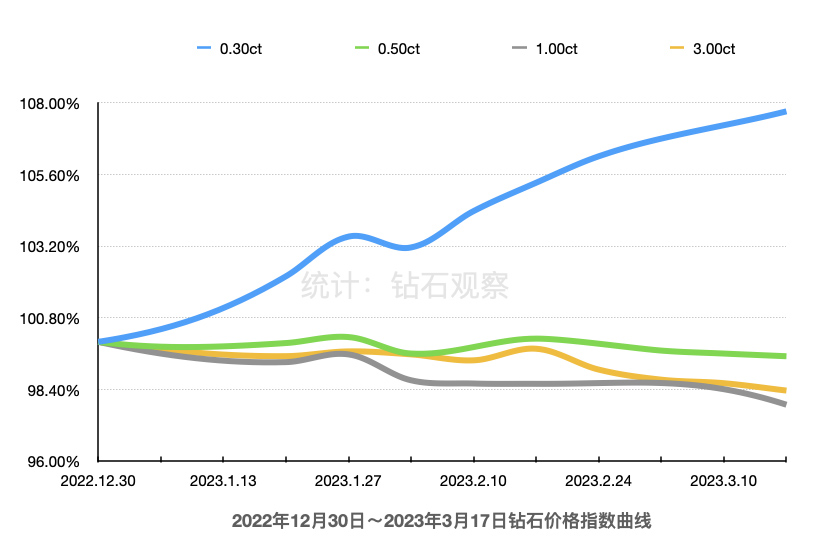

In terms of the price of bare diamonds, the natural bare diamond price index in the 0.30ct range continued to rise this week, and the increase (+0.49%) was higher than last week (+0.39%), further widening the price trend difference between small and large diamonds since the beginning of this year. The price indices of other weight segments (0.50ct, 1.00ct, 3.00ct) showed varying degrees of decline, with the 1.00 carat segment showing a more significant decrease. (As shown in the figure below)

▲ Figure 1: 0.30ct Price Index Continuously Rising

▲ Figure 2: The price of small particle bare diamonds performed well this week

The following is the market situation for each region this week, sourced from Rapport:

U.S.A

Wholesale trade is gradually warming up, and orders for consignment sales remain stable, with a decent sales rate. Mainstream jewelry retailers are purchasing goods. Long elliptical, cushion shaped, and emerald shaped diamonds are selling well. The rice grain diamond market remains strong. The demand for diamonds from European style and old mining cutters is decreasing.

Belgium

The market is relatively stable, but emotions are mixed. With the return of Chinese buyers, the diamond sector has performed well. Commercial quality diamond wholesalers maintained a cautious attitude after the Hong Kong exhibition, which reflected stable demand, but buyers remained somewhat subdued overall. Suppliers are beginning to re familiarize themselves with Chinese customers. The quantity of rice grain diamonds is relatively small.

Israel

The sales pace is relatively slow, and wholesalers feel a bit worried. The market turmoil caused by the Hong Kong exhibition has rapidly cooled, and Chinese buyers are testing prices and may make more purchases in the second half of the year. With the continuous increase in the price of small particle rough drills, processing plants are more concerned about their profit in this sector. The industry is relatively optimistic about Israel Diamond Week, which will take place from March 27th to 30th.

India

The recovery of the Chinese market is driving market development. There has been a slight decline in local diamond demand in India, and Surat's diamond sales are better than Mumbai's, especially for small grain diamonds. The sales of shaped diamonds are strong, with 0.30-1.99 carats of pear shaped, oval shaped, and emerald shaped diamonds showing good sales performance. Although the prices of rough diamonds have recently risen, demand has remained stable, and some processing plants are seeking to increase the production of bare diamonds. Overall, the production capacity of the processing plant is still not high, which has caused a shortage of bare drill supply in certain specific sections.

Hong Kong, China

Trade activities increased, market sentiment was good, and the effect of Hong Kong exhibitions continued. Orders for 1-3 carats of diamonds are good, with good demand for shaped and colored diamonds. Mainland buyers are still cautious and are focusing on products with cheaper prices and lower profit margins. Wholesalers are optimistic about the market recovery in the second half of this year. Jewelry retail in mainland China is relatively weak, while local retail in Hong Kong is on the rise.

Please refer to the above content with caution.