Why? Because they occupy the middle reaches.

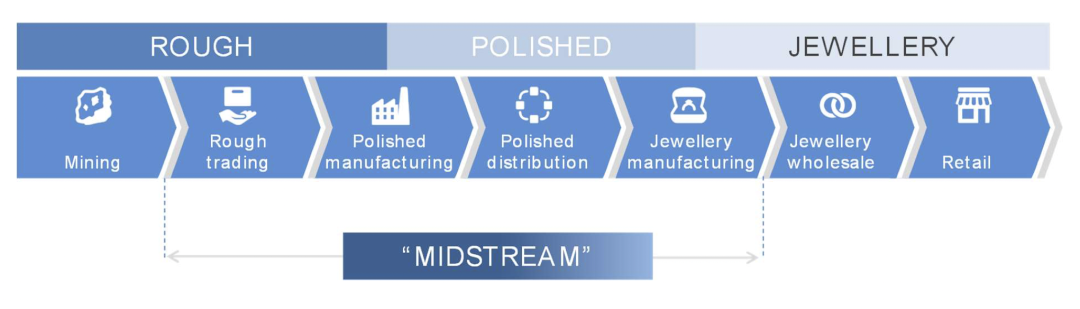

What is midstream?

Starting from the trade of rough diamonds, through cutting and grinding processing, sales of finished diamonds, and all the way to the production of finished jewelry (inlay), this entire period is known as the "middle reaches of the industry". So we often say that the middle reaches are the throat of the diamond industry, and that's the reason. If there is a lack of middle reaches, communication between upstream and downstream will not be possible unless downstream people can enjoy wearing blanks on their bodies.

What is the role of midstream besides "changing diamonds"? Of course there is. The biggest role of midstream is to communicate information and coordinate the industrial chain. The reason why De Beers has been able to develop to its current scale is not only because it once monopolized resources and invested heavily in downstream marketing ("Everlasting"), but also because it relies on many market information feedback from midstream players.

By the way, currently more than 60 customers of De Beers are divided into three categories: cutting and grinding factories, large retailers with cutting and grinding functions, and rough diamond traders. Among them, customers with cutting and grinding functions are more valued because they can "digest" rough diamonds, rather than raising prices in the secondary market, thereby affecting the price of the final product diamond

Is the mid stream profit high? If we only look at cutting and grinding processing, it is indeed not very high. The Indian media complained that the profit from natural diamond grinding is only 4.5%, which is a fact. But when it comes to the 'entire midstream', the profits are considerable. How high is the added value of buying blanks for tens or hundreds of dollars and selling them to the European and American markets after cutting them? If embedded into finished jewelry, it can even support many people.

Some people say that "India mostly cuts small particles with low value". This is true, but we need to look at scale and the impact it brings. It is an undeniable fact that small diamond particles are widely used downstream. Where do the small particles used by luxury brands in Europe and America come from? Most of them are Indian goods. How did Russian diamonds return to the international market? The operation of India is a crucial factor.

Can the attitude of the middle stream affect the pattern of the industrial chain? Of course you can. When the COVID-19 just broke out, India predicted that the downstream market was extremely unsatisfactory, and immediately reduced the procurement of rough products from the upstream until GJEPC issued a document calling for "30 days off purchase", completely pressing the pause button for the diamond industry.

Upstream enterprises immediately began to gradually reduce prices or adopt flexible sales policies to meet India's demand for profits. During that period, the middle reaches had a strong bargaining power over the upstream. Later, as the epidemic passed and the market improved, De Beers and Eroza began to recover their previous losses through several rounds of price increases.

In recent months, because the downstream market has shrunk due to the impact of US inflation, China's epidemic situation and the Russia-Ukraine conflict, India has not been active in market prediction, so imports have continued to decline month on month. This has affected the emotions of many people, including the cultivation of diamond production in our country. All of these things are understood by our trading partners in rough diamonds.

This is the importance of the midstream. Its core competitiveness lies in a country (or region) expanding its interests and influence to the entire supply chain on the basis of mastering large-scale cutting and grinding, thus obtaining considerable initiative. In certain extreme environments, this initiative can become the "capital" for the midstream to shake the pace of upstream production and downstream market development.

India controls over 90% of the global diamond cutting and grinding work, so their data is always valued, their views are always reprinted by major institutions, and they dare to expand CVD production so aggressively (even if it is only low-end quality). If you switch to other countries, you have to think about the issue of "who can handle so many blanks", and India doesn't have to worry because they have 800000 starving cutting and grinding workers. Allowing these people to have work to do, and even more people to have work to do, is a pressing need for the Indian government and the capital community.

And what about us? Sorry, that's all that's missing.

To put it bluntly, from the perspective of the industrial chain, our position in the natural diamond industry chain is not high. Occasionally, there are several vendors and cutting and grinding units, but they have never been able to cause a tilt in upstream resources, let alone shake India's position. For decades, we have only obtained psychological comfort by driving downstream demand: by expanding the market, our bargaining power in the face of midstream will be enhanced. In the years after the financial crisis, it was true that the entire industry was relying on the Chinese market at that time. But looking back, is this bargaining power really long-term stable?

How about cultivating the diamond industry? The situation is relatively better, at least we can produce blanks, and the output is quite large. But ask ourselves, how much raw material can we digest ourselves? 10% or 20%? Did most of it still arrive in India? In the early stages of industrial development, we were not worried because Indians needed goods, and the rough diamond trade was a seller's market. But what will happen later? Expansion of production, internal competition, and India's own development of CVD production... Who will have stronger bargaining power between us and India then? It's really hard to say. Friends who have been in the rough diamond business lately must understand this matter.

I have always been optimistic about the diamond industry and have been optimistic about China's development in the industry chain, including natural diamonds and cultivated diamonds. So this article is not about downplaying the industry, but rather proposing an idea: we need to face our own gaps and remain vigilant at all times. Whether at the policy level, capital level, or within the industry, we should understand where our weaknesses lie. To break free from the bad habit of nearsightedness and truly solve fundamental problems, as long as one's thinking does not slide, there are always more methods than problems.