The most direct issue caused by this is the widespread production reduction of Indian factories located in the middle reaches. Nevertheless, Rapport believes that the inventory of bare diamonds in the midstream is still large.

The reasons for the reduction in production are multifaceted. In addition to limited supply, the downstream market situation is still quite troublesome. The uncertain economic environment continues to affect the emotions of jewelry retailers, causing them to hesitate when purchasing inventory and instead adopt consignment sales to avoid inventory risks.

At the same time, the US media announced that the consumer confidence index fell to a new low in April. (Note: Reuters' message is' lowest in 9 months', but according to other institutions' disclosure, it may be the lowest in 5 months, as shown in the following figure)

▲ On the left is the title of the Reuters article, and on the right is the data published online

In addition to the United States, retailers in mainland China also generally maintain a cautious attitude.

Under this influence, the upstream rough trade has been affected to a certain extent. It is said that De Beers has increased the flexibility of buyers in procurement, and specific information remains to be disclosed.

Nevertheless, we can still see some positive news: luxury brands at the top of the "pyramid" are still performing well, NRF expects jewelry consumption to hit a new high during Mother's Day in the US market, and the industry is optimistic about next week's Geneva Jewelry Show and the Las Vegas Show at the end of May. These pieces of information have to some extent boosted market sentiment.

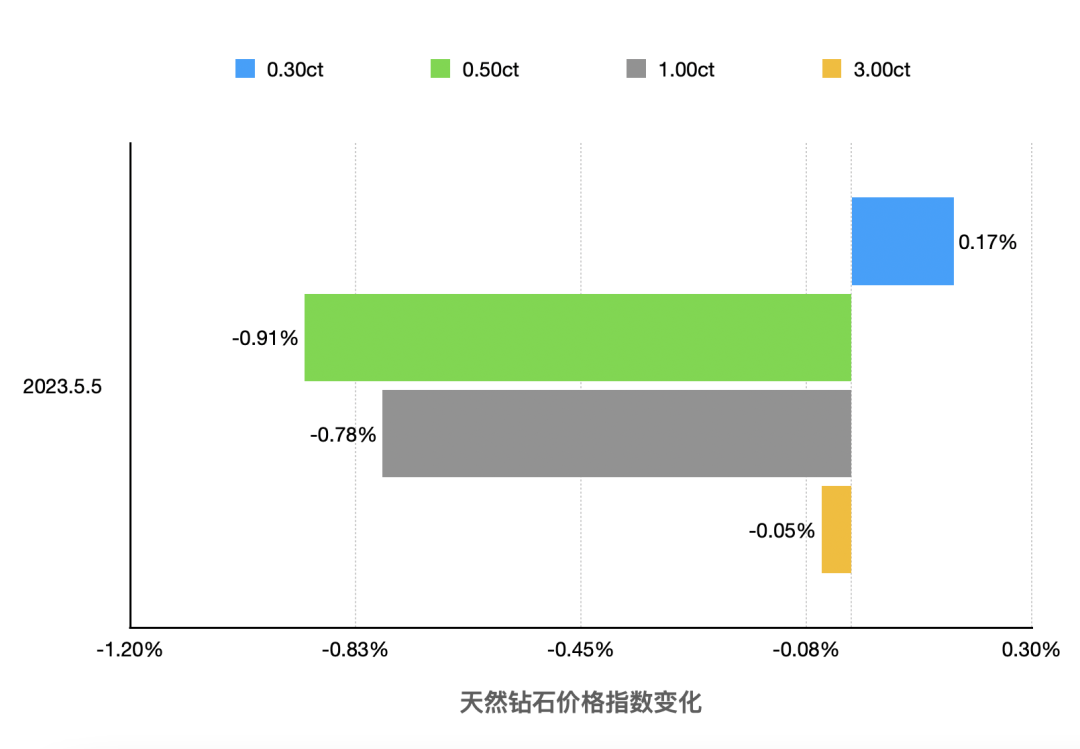

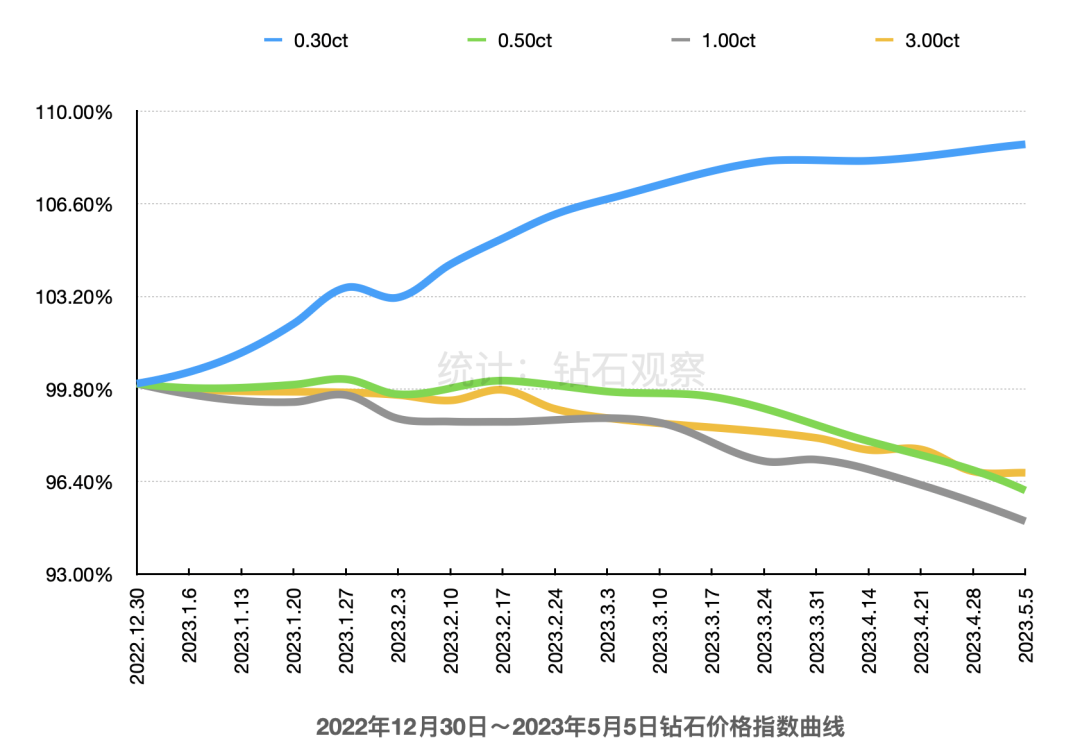

As usual, we have compiled the diamond price changes as of May 5th based on the data provided by Rapport. Please refer to:

▲ Data source: Rapport

The following is the market situation for each region this week, sourced from Rapport:

U.S.A

The development of the finished diamond market is slow, and wholesalers are generally concerned about price reductions. The weakness of wedding retail has led to a decrease in wholesale trade volume. The market performance of irregular diamonds continues to outperform that of circular diamonds. Suppliers have taken a positive attitude towards the Las Vegas exhibition from May 31st to June 5th, hoping to stimulate sales growth.

Belgium

The demand in the US, China, and European markets is relatively low, and the diamond trade volume is relatively small. Due to the good performance of high-end luxury goods, the industry is generally optimistic about the Geneva Jewelry Exhibition to be held next week. The demand for diamonds with a purity level of 0.30-1.00 carats, H-I colors, and SI2 is stable. The irregular diamond market is stable. De Beers remained cautious in the rough diamond market during the trade fair.

Israel

Wholesalers are concerned about the sharp decline in trade volume and market demand. The finished diamond market is weak, and the procurement volume from the United States is also decreasing. Oval and pear shaped diamonds with VS cleanliness level are the best performing segments among all irregular diamonds. In April, the export volume of finished drilling products from Israel decreased by 69% to 138 million US dollars (note: the same period last year was 4437 million US dollars); The total export value in the first four months of this year was 976 million US dollars, a year-on-year decrease of 44%.

India

The decline in orders between China and the United States has kept the market calm. The local market in India remained stable, with the opening day on April 22nd stimulating sales of gold and jewelry. It is said that local Indian consumers are inclined to purchase higher quality jewelry products. The processing plants have a large amount of inventory, so they have reduced the production capacity of bare diamonds. Suppliers are becoming increasingly cautious in responsible procurement.

Hong Kong, China

Affected by weak demand in mainland China, the mood of the wholesale level is relatively low, and the diamond price reduction has not stimulated sales. The local retail situation in Hong Kong is improving due to an increase in tourists. The performance of the mainland market is average, with diamond sales of 0.30 carats, 0.50-0.70 carats, D-J colors, and VS-SI purity grades showing good performance. The market performance of irregular diamonds is stable and superior to that of circular diamonds.

Please refer to the above content with caution.