Sean Bryant published an interesting article on Yahoo Finance Channel yesterday (the title is shown in the picture above), listing "7 categories of products with the most depreciation", including diamond jewellery.

This article is obviously written for consumer groups. It is believed that the price increase rate of diamond jewellery (finished product) is 300%-1000%, that is, about 3 to 10 times. Therefore, if (consumers) sell it, they will find that their income is far lower than the "cost" (that is, the price at which it was bought).

An organisation called Diamond Pro is quoted in the article. We checked and found that its founder, Ira Weissman, was mainly engaged in diamond wholesale before 2010. In 2009, he founded a website called Truth About Diamonds, and in 2014, it was renamed Diamo. Nd Pro (diamond expert).

According to Ira's partner and current CEO Michael Fried, the two have worked in the diamond industry for more than 20 years and felt "left a bad taste in our mouths", so they simply voted for it later. I'm in the matter of "helping consumers understand the truth of the industry". Therefore, the main job of Diamond Pro now is to do some information disclosure, consulting services and so on.

Source: Diamond Pro

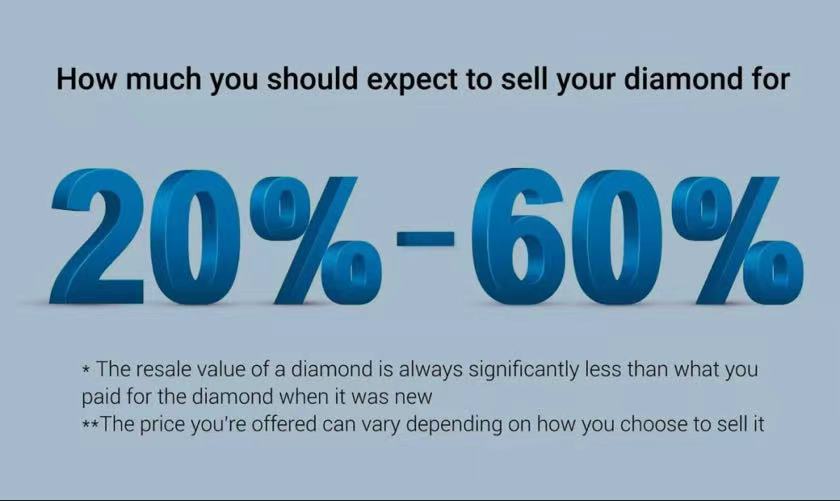

Compared with Yahoo Finance, Diamond Pro talks more about the value and realization of diamonds than diamond jewellery.

They make a distinction between offline and online retail, believing that offline stores are expensive, so the price increase rate for diamonds alone is of course very high. In contrast, the price increase rate of online stores is relatively limited. For example, in relatively affordable online brand stores such as James Allen and Blue Nile, the price increase rate of bare diamonds is about 18%.

So on the whole, if a consumer buys a diamond from the retail side and sells it, the return is basically 20%-60%.

Source: Diamond Pro

Of course, today's article is not to discuss how much diamond recycling can still be worth, but to briefly say a few words about the publicity that "diamonds can maintain value and increase in value".

There used to be a saying in the retail market:

"The diamond you bought for 50,000 yuan this year will cost 55,000 yuan next year, so your stone has increased in value."

For the "buy, don't sell" group, they do feel that they have saved money (if the retail price keeps rising), which is a good "investment". It's just that people will prefer to know how the price is constituted and whether the merchant has too much and unreasonable premium.

But for groups who want to sell capital preservation and make money, the above sentence is a complete pseudo-concept, because as long as you have a little business common sense, you know that it is almost impossible to benefit from recycling at the end of the supply chain, unless you can find someone who is willing to sacrifice his own interests to replace you. The next takeover.

Sometimes, merchants (such as some platforms) can really help you find someone and spend more money to buy what you want to recycle, so that you can benefit.

However, because the network information is becoming more and more developed and the industry is becoming more and more flat, in most cases, no one is willing to do so (unless your product has a strong brand endorsement), so you can't achieve the effect of preserving and increasing value by reselling this product.

Therefore, when consumers were excited to sell the stone in their hands for 55,000 yuan, they found that they were only willing to pay ten or twenty thousand yuan, so they were angry: "This is a scam!"

Over the years, some practitioners have made a fundamental mistake, that is, when publicising to consumers, distorting the "high value of diamonds" into "value preservation and appreciation" and excessive rendering. Perhaps they think that consumers, like merchants, are people who like to make money, so let them see "value preservation and appreciation", which is conducive to their own sales.

As for whether the other party wants to "buy or not sell" or want to "sell to keep the capital and make money", the merchants who shout value preservation and value-added do not care. After all, if you buy diamonds, how many people still want to sell them to make money?

So over time, especially when the economy was down, when cash was king, and everyone covered their pockets, the "pseudo-concept" was broken. People who found themselves unable to make money through recycling shouted "scams" and launched a public opinion attack on the diamond industry under the threat of the media.

Perhaps this result was doomed when people first created a false concept.

Fortunately, we have rarely seen the promotion of value preservation and appreciation on the C-end, and more about the rarity, aesthetics, commitment and sustainable development of diamonds. Rapaport does talk a lot about "resale value", but it is aimed at wholesalers and retailers in the industry.

We don't know why Yahoo Finance published that article. After all, the Finance Channel prefers to talk about whether to make money or not. But for the retail level of the diamond industry, the era of value preservation and appreciation has indeed passed. As a kind of consumer goods with strong emotional attributes, diamonds need more output at the emotional level, rather than the publicity of buying and selling for a few yuan.

Source: Diamond Observation